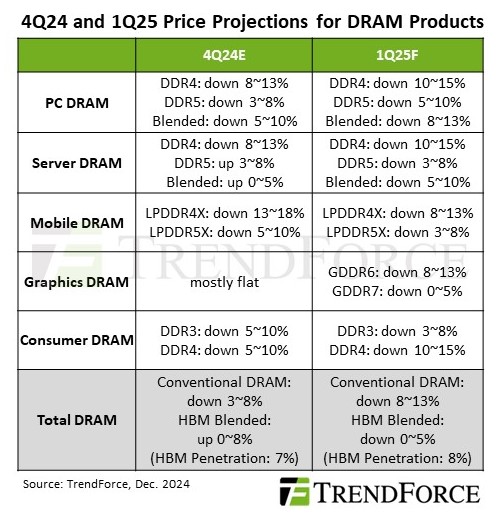

Global DRAM prices are expected to experience a notable decline in the first quarter of 2024, with forecasts predicting a drop of 8 to 13%. Seasonal off-peak demand and persistent global uncertainties are key factors driving this downturn, according to a report by market research firm TrendForce.

Price Trends and Contributing Factors

TrendForce revealed that DRAM prices are already on a downward trajectory, falling by 3 to 8% in Q4 2023. This trend is set to intensify in early 2024 as the market enters a traditionally weaker season compounded by sluggish consumer demand for products like smartphones and laptops.

High-bandwidth memory (HBM), which has seen robust demand, helped stabilize overall DRAM prices in the fourth quarter with an increase of up to 8%. However, even HBM’s inclusion in Q1 2024 is expected to soften the decline only marginally, reducing the drop to a range of 0 to 5%.

Server and graphics DRAM, which experienced price increases in Q4, are projected to follow the broader market trend and decline in Q1 2024. The price of DDR5 server DRAM, for instance, is forecast to fall by 3 to 8%, reversing gains seen in the previous quarter. DDR4 server DRAM is expected to see an even sharper decline, with prices dropping 10 to 15%.

Market Segment Price Drop Projections

| Market Segment | Expected Price Drop |

|---|---|

| PC DRAM | 8-13% |

| Server DRAM | 5-10% |

| GPU VRAM | 5-10% |

Market Dynamics

The DRAM market is under pressure from seasonal demand weakness, compounded by overstocking earlier in the year. Additionally, manufacturers have shifted production capacity from DDR4 to DDR5 and even converted some HBM production lines to DDR5, leading to increased supply and further pressuring prices.

PC, mobile, and consumer DRAM segments are expected to mirror the broader trend, continuing their price declines from late 2023 into the first quarter of 2024.

What is a DRAM?

Dynamic Random Access Memory (DRAM) is a type of volatile memory commonly used in computers, smartphones, and other electronic devices to store data temporarily while the device is in use. It provides high-speed access to data by storing it in capacitors within an integrated circuit.

However, because DRAM is volatile, it loses data when power is removed, requiring constant refreshing to maintain the stored information. Its fast performance and ability to handle large amounts of data make it essential for tasks like running applications and managing operating systems.

Looking Ahead

TrendForce noted that “the DRAM market in Q1 2024 will face downward price pressure due to weaker seasonal demand and ongoing global uncertainties.” While HBM demand remains a bright spot, it is unlikely to offset the overall downward trend in DRAM pricing.

These dynamics reflect the shifting landscape of the memory market, where increased production capacity and softened consumer demand create an environment of sustained price declines across most DRAM segments.

Leave a Reply