In today’s globalized world, sending and receiving money internationally has become a common necessity. As a result, numerous money transfer services have emerged to meet this demand. PayPal and Wise (formerly known as TransferWise) are two prominent players in this field. In this guide, we will explore the features, pros, and cons of both PayPal and Wise to help you make an informed decision when it comes to transferring your hard-earned money.

1. Introduction to PayPal and Wise

PayPal, founded in 1998, is a widely recognized and trusted name in the online payment industry. It offers a range of services, including money transfers, online shopping payments, and peer-to-peer transactions. On the other hand, Wise, established in 2011, focuses specifically on international money transfers, aiming to provide a more cost-effective solution compared to traditional banks.

2. Ease of Use

PayPal boasts a user-friendly interface, allowing users to send money to friends, family, or businesses with just a few clicks. Creating an account is straightforward, and the platform offers integration with various online platforms, making payments seamless. Wise also offers a user-friendly experience, guiding users through the process of transferring money abroad and providing clear instructions at each step.

3. Transaction Fees

When it comes to transaction fees, PayPal charges a percentage-based fee on the total amount being transferred, varying depending on the countries involved and the payment method used. Wise, on the other hand, employs a transparent fee structure, clearly stating the fees upfront. Wise generally charges a low, fixed fee, making it an attractive option for individuals and businesses who frequently transfer money internationally.

PayPal: Transaction fees for PayPal vary depending on the country and payment method used. Here are a few examples:

Wise: Transaction fees, Wise follows a transparent fee structure and generally charges a low, fixed fee. Here are a few examples:

[table id=6 /]

4. Exchange Rates

One crucial aspect to consider when comparing money transfer services is the exchange rate offered. PayPal’s exchange rates are known to be less competitive compared to Wise. Wise uses the mid-market exchange rate, which is the real exchange rate with no markup. This ensures that users get a fair and transparent rate, resulting in more savings compared to PayPal.

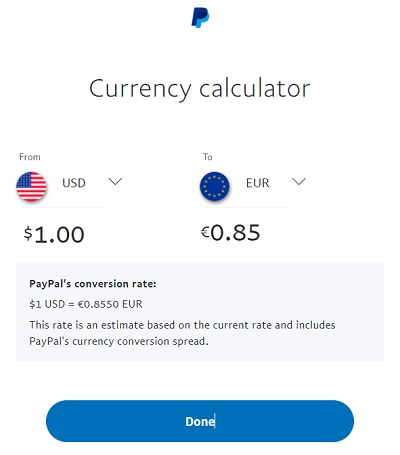

How to Check PayPal Exchange Rates or Access Currency Converter?

PayPal provides currency conversion and exchange rate information through their website. You can find PayPal’s currency calculator and exchange rates by following these steps:

- Visit the PayPal website (www.paypal.com) and log in to your PayPal account.

- Once logged in, click on “Payment Methods” in the top menu.

- On the left side, click on “Currency Converter.”

- The Currency Converter page will open, allowing you to enter the currency and amount you want to convert.

- Select the currency you want to convert from the “From” dropdown menu and the currency you want to convert to from the “To” dropdown menu.

- Enter the amount you wish to convert in the “Amount” field.

- Click on the “Calculate” button to view the converted amount.

- Below the conversion result, you will see the exchange rate used by PayPal for the conversion.

Please note that PayPal’s exchange rates may include a small markup compared to the mid-market rate. The specific exchange rate and any applicable fees will be shown on the Currency Converter page.

It’s important to remember that exchange rates may fluctuate and can vary depending on the specific transaction or funding source within PayPal. For the most accurate and up-to-date information, it is recommended to use PayPal’s Currency Converter or contact PayPal directly for any currency-related inquiries.

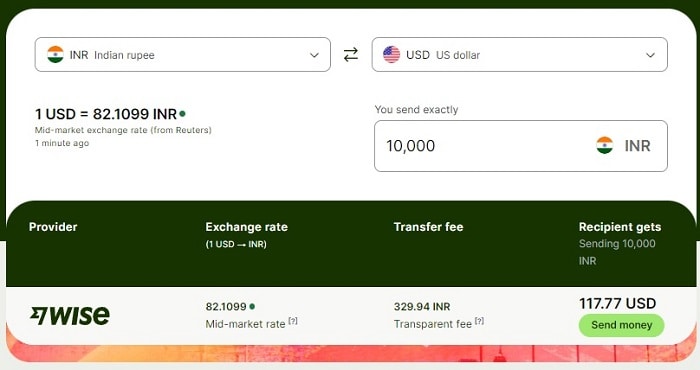

How to Check Wise Exchange Rates or Access Currency Converter?

Wise provides real-time exchange rates on its website, allowing you to easily check the rates for different currency pairs. To find Wise’s exchange rates, you can follow these steps:

- Visit the Wise website (www.wise.com) and navigate to the homepage.

- At the top of the page, you’ll find a currency converter widget.

- In the “Send” field of the currency converter, select the currency you have or want to convert from.

- In the “Receive” field, select the currency you want to convert to.

- Enter the amount you wish to convert in the “You send” field.

- The “Recipient gets” field will display the converted amount based on Wise’s exchange rate.

- You can also click on the small arrow icon next to the “Recipient gets” field to view the detailed breakdown of the exchange rate, including the rate, fee, and estimated arrival time.

Wise’s exchange rates are usually based on the mid-market rate, which is the real exchange rate with no additional markup. However, it’s important to note that Wise may apply a small transparent fee to the conversion, which will be displayed in the breakdown.

By using the currency converter on the Wise website, you can check the most up-to-date exchange rates for various currency pairs and make informed decisions regarding your money transfers.

5. Transfer Speed

PayPal offers near-instant transfers within its network, allowing users to send money to others who also have PayPal accounts. However, international transfers may take a few days to complete. Wise provides estimates on the time it takes for money to reach the recipient, which can vary depending on the destination country and the payment method chosen. Generally, Wise offers competitive transfer speeds, often completing transactions faster than traditional banks.

6. Security Measures

Both PayPal and Wise take security seriously to protect users’ financial information and transactions. PayPal offers buyer and seller protection, advanced encryption, and two-factor authentication for added security. Wise employs similar security measures, such as two-step verification, secure data handling, and robust anti-fraud systems, ensuring the safety of users’ funds.

7. Accessibility and Supported Currencies

PayPal is available in numerous countries worldwide and supports a wide range of currencies. It allows users to send and receive money domestically and internationally. Wise supports even more currencies and operates in a larger number of countries, making it a preferred choice for individuals and businesses dealing with multiple currencies or specific regions.

8. Integration with Other Platforms

One of PayPal’s strengths is its extensive integration with various e-commerce platforms and online marketplaces. It is widely accepted by online merchants, making it convenient for individuals to make payments. Wise also offers integrations with some platforms, but its primary focus is on international money transfers rather than online shopping.

9. Customer Support

Both PayPal and Wise provide customer support, although the quality and availability may vary. PayPal offers multiple channels for customer support, including phone, email, and an extensive knowledge base. Wise offers support through email and live chat, with a reputation for responsive and helpful customer service.

10. Pros and Cons of PayPal

Pros:

- Widely recognized and accepted

- Easy-to-use interface

- Extensive integration with online platforms

- Buyer and seller protection

Cons:

- Higher transaction fees

- Less competitive exchange rates

- Slower international transfers

11. Pros and Cons of Wise

Pros:

- Transparent and low transaction fees

- Competitive exchange rates

- Fast international transfers

- Multi-currency support

Cons:

- Limited integration with online platforms

- Less recognized compared to PayPal

12. Conclusion

In the comparison between PayPal and Wise, both money transfer services offer unique advantages. PayPal is more suitable for individuals looking for convenience, widespread acceptance, and integration with online platforms. On the other hand, Wise excels in providing cost-effective international transfers, competitive exchange rates, and multi-currency support. Ultimately, the choice between PayPal and Wise depends on your specific needs and priorities.

13. Frequently Asked Questions (FAQs)

Q1. Can I use PayPal or Wise to receive money from abroad? Yes, both PayPal and Wise allow users to receive money from international sources.

Q2. Can I link my credit card to PayPal or Wise? Yes, both services provide the option to link your credit card for payments and transfers.

Q3. Are there any limits on the amount of money I can transfer with PayPal or Wise? Both PayPal and Wise have certain limits on the amount of money you can transfer, depending on various factors such as your account status and country regulations.

Q4. Which service has better customer support? Customer support quality can vary, but both PayPal and Wise strive to provide assistance to their users.

Q5. Can I use PayPal or Wise for business transactions? Yes, both PayPal and Wise offer services tailored to business transactions, with features such as invoicing and integration with e-commerce platforms.

Leave a Reply